Brings Peace of Mind

Written by Wills & Estates Principal Lawyer, Brooke Reardon.

Dying or becoming incapacitated without up-to-date succession documents can cause serious emotional and financial hardship for those around you. Being proactive about your succession plan however, can provide numerous benefits, putting your mind at rest and bringing peace to your life.

According to the Australian Bureau of Statistics, there were just over 169,300 deaths recorded in Australia in 2019, with nearly 99% of these deaths being adults. Numerous studies have reported that approximately half of these deaths are individuals without a Will, not including those who died with a Will that did not reflect their up to date wishes or was invalid. Many people delay getting or updating their Will for numerous reasons; affordability, accessibility, procrastination and misunderstanding or minimization of the consequences of dying without a well drafted Will. The benefits of planning your succession documents with an experienced lawyer outweigh any potential downsides.

You Decide Where Your Assets Go

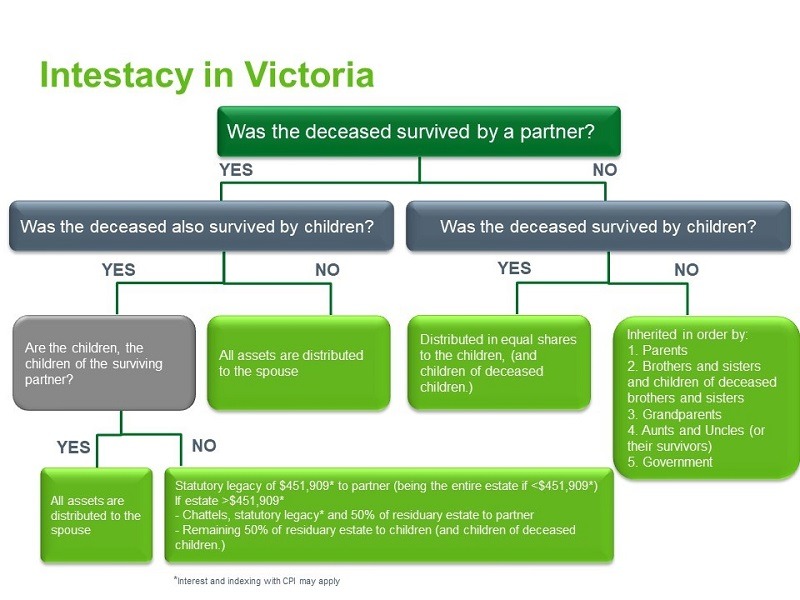

When an individual dies without a Will, the legal term for this is ‘intestate’. The laws of each State determine what happens to a person’s estate when they die intestate. The law may or may not reflect your wishes for your estate, particularly where you have a blended family, no family or the law’s provisions are inadequate for your beneficiaries. IOOF has a comprehensive easy to read flow chart for each State if you are interested in seeing what would happen in your circumstance to your estate if you died intestate:

For example, if you have no surviving relatives, then the Government will take your estate. Perhaps you would rather see your favourite charity inherit your estate?

As long as an individual adheres to the legal requirement to ensure that they have made provisions for the ‘proper maintenance and support’ of a person ‘for whom he or she had responsibility to make provision’, you have the freedom to make a Will on whatever terms you wish. This means that while you are alive you can write a Will that excludes people from your estate, gives gifts reflective of you wishes and preserves your estate for your children and grandchildren from their partners and any potential family law claims. If you do not make a Will, you have missed the opportunity to exercise your right to decide what happens to your estate when you die.

Even when you have made a Will it is important to ensure it is kept up to date as your life changes. Some life events that should trigger a review of your Will with a Lawyer include starting a business, entering or leaving a relationship, having children or other changes in beneficiaries, and changes in wealth including bankruptcy. It is important to remember that you can only create a Will while you have testamentary capacity.

Guardianship

If you have children, you can nominate who you would want to act as your children’s legal guardian by including this direction in your Will. If the other natural parent of your child is not fit to act as guardian, then it is imperative that you exercise your right to choose. This can help prevent any family discord or confusion, also in the scenario if both you and the other natural parent were to die.

Funeral Arrangements

A Will is a good place to outline your funeral wishes, however it is important to detail them in a separate document and speak about it with your loved ones, especially any religious rites or body handling requests you would like to include. If you strongly wish to be cremated, then a direction to do so in your Will is binding on the Executor.

Binding Death Benefits & Tax Strategy

When you die it is important to have a Will and a Binding Death Benefit Nomination that consider tax implications as part of the estate distribution overall strategy. A Binding Death Benefit Nomination tells your superannuation trustee where to pay any proceeds in the event of your death. If you die without a valid or current nomination, your superannuation company has discretion to decide where to pay the proceeds. They may choose to pay it to your new boyfriend, over your mother who you had nominated, as was the case when REST Super paid Ashley Petrie’s superannuation death benefit to Rodney Higgins (https://www.theage.com.au/national/victoria/magistrate-who-had-relationship-with-young-court-clerk-wins-her-super-benefit-20210616-p581hg.html).

Where superannuation benefits are paid to non-tax dependants, the beneficiaries will be personally liable for tax. A financial dependant, however, does not pay tax. Further a testamentary trust structure can be useful for taxation purposes. A testamentary trust is a trust that is established in your Will, only coming into effect upon your death. If established, distributions made to minors within the trust are taxed at adult tax rates, rather than minors. There are numerous other advantages of a testamentary trust from a protection of assets standpoint as well.

Advance Care/Health Directives & Enduring Powers of Attorney

These are legal documents where you can give instructions about your personal, financial and future health care while you are living. An Enduring Power of Attorney can come into effect when certain conditions are met, or immediately upon making. An AHD comes into effect when you lose the capacity to make your own decisions which can occur for a range of different reasons including a brain injury or a disease such as Dementia. By having these documents in place you can ensure that your wishes are known and that you are taken care of the way you want to be if you lose capacity.

Knowledge

By seeking expert advice and getting your succession documents in place you exercise your right to choose, making a fully informed decision, giving you peace of mind! For specific legal advice in relation to your personal situation, contacting a succession lawyer is advised.

Exercising Your Right to Choose Exercising Your Right to Choose Exercising Your Right to Choose Exercising Your Right to Choose